|

Our main purpose is to offer the highest quality product at a competitive price to meet our customers’ needs and requirements and to build a relationship based on mutual trust. After reviewing the specific needs and investment objectives of any prospective client, Davisgioielli Group 1962 will make clear recommendations and advise on potential solutions. After that, we act immediately to find either internally or through our network what requested by our clients to whom we provide a complete service that extends to the possible relocation of the stones on the market. As we consider our clients as partners, it is our primary interest to advise them in order to enable them to make the right purchase, a purchase that would suit their needs.

Our philosophy is to offer diamonds not in the light of an investment but more as a form of protection of savings. These days we are going through a scenario of global economic crisis. Some European countries - including Italy, are in great difficulty with a high public debt and GDP in suffering. The first objective of a wise investor is therefore to protect his savings and today buying loose diamond is considered an advisable and convenient form of financial investment. Among the options of the diversification of investments, diamonds represent a real opportunity as they are considered a safe haven ‘par excellence’ especially in a period of high volatility in financial markets and a high quotation of gold.

Diamonds are a tangible investment. Natural diamonds are still a

real asset and not a financial product.

✔ They are the only gemstones to have a reliable certification system and an official price list published internationally (Rapaport Diamond Report)

✔

Their value is more stable compared to other precious stones thanks to important

manufacturers. In recent years, the natural diamond market has seen a decline in

prices due to several factors, including the very low cost of lab-grown

synthetic diamonds, fluctuations in global demand, and economic dynamics

affecting the luxury sector. ✔ They are anonymous products and in Italy do not generate taxable capital gain such as investment gold and gold coins, which generate capital gains at 26% as financial income. Furthermore: ✔ Diamonds is a discreet and transportable investment that combines high intrinsic value with small size and weight. ✔ They are considered an ethical investment as the diamonds we supply are “conflict free” which means that they have been purchased from legitimate sources not involved in funding conflicts and in compliance with the United Nations resolutions. ✔ Diamonds are precious, rare and prestigious objects that we can “enjoy” in the period of while we own them. Those who purchase natural diamonds seek uniqueness and rarity and desire to acquire luxury. Each diamond has a unique history, beginning with the millennia-old geology in which it was formed, continuing through its processing, and ending at your finger. HOW TO PROTECT OUR SAVINGS? In a scenario of global economic wars, our first aim is to protect our savings. Investing in diamonds means to invest – for as long as we wish – a small part of our savings in order to ensure that for the next 10+ years our capital will be protected by inflation and devaluation, political crisis or natural disasters. It is also a mean not only to avoid any temptation to speculate and provide us with a form of personal life insurance but also to guarantee our off spring a tax free capital. To possess high intrinsic value safe havens such as diamonds especially in those times of uncertainty is therefore to be considered as a viable option/solution to protect our savings. HOW TO CHOOSE AN INVESTMENT DIAMOND? 👉 Color: It is recommended to choose a colour between D and F mostly because the higher level you choose the less possibilities you have to sell it in the future (you reduce the number of potential buyers). On the other hand if you choose a lower grade such as H-I, gradients are already visible to the naked eye.

👉 Clarity: As to purity it is suggested to choose the best quality is FL or IF (Flawless or Internally Flawless).

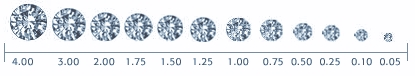

👉 Cut: Considered the purpose, the best cut for an investment diamond is the round brilliant cut. It is essential that both the quality and the proportions of the cut matched the parameters established by the gemological laboratories (Triple Excellent).

👉 Weight: The best value for investment diamonds are stones that range from 0,5 to 2 carats which are easy to be disinvest. This is why we recommend to investors to purchase several diamonds of the above characteristic instead of a bigger single gem.

|